AnaRosario

Active Member

- Time of past OR future Camino

- Pomplano to Santiago (March 29-May 6 2018)

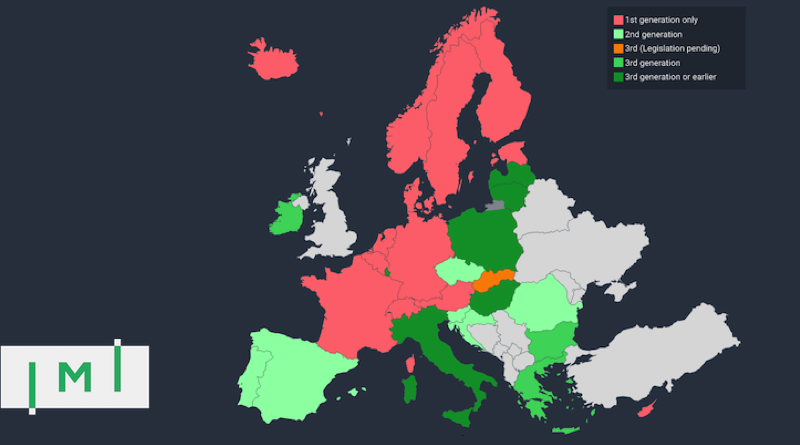

I love the country of Spain, my last journey in 2018… It was decided this is where I want to live, but I don’t know the process, and unfortunately I’m not really good at following instruction nor waiting. So, if you know how to do it, please help me. I am planning on coming back to Spain after January 2023, and will be walking the Camino Frances. Where would I go to begin the process of legally remaining in Spain or Portugal or Italy?