Ungawawa

Active Member

- Time of past OR future Camino

- 2017-20: Francés, Norte, Francés, Portuguese Lisbon Coastal, Portuguese central

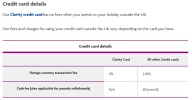

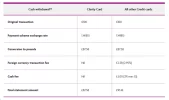

Can people please post below their cash machine usage charge costs from experience / currently from the camino? I'm talking about the Spanish ATM on-the-spot usage fees, that are charged regardless of your home bank. The ones they ask you to confirm at the end before giving you the money.

If you have gone on the camino in the last year or two, you may have noticed that banks now vary greatly in their fees to use cash machines. These fees are additional to the percentage and foreign-use fees that your bank will probably charge you. They can range from zero to some cents to €5. - that could be an additional 3-5% on your average withdrawal!

I would like to collect details on which banks charge what to put in a PDF or image for this forum that you can carry on your phone.

Please, real-life recent charges only, because these fees have changed within the last year.

I'll start this off below and copy any submissions into the top same post.

If you have gone on the camino in the last year or two, you may have noticed that banks now vary greatly in their fees to use cash machines. These fees are additional to the percentage and foreign-use fees that your bank will probably charge you. They can range from zero to some cents to €5. - that could be an additional 3-5% on your average withdrawal!

I would like to collect details on which banks charge what to put in a PDF or image for this forum that you can carry on your phone.

Please, real-life recent charges only, because these fees have changed within the last year.

I'll start this off below and copy any submissions into the top same post.

Last edited: